Topgolf: A Failed Acquisition

Good strategy mixed with bad operational execution to create a failed acquisition

Context

Golf brand Callaway bought up-and-coming entertainment venue Topgolf in March 2021.

Now, just 3 years later, Topgolf is being spun out from Callaway back into a separate brand.

What went wrong so fast?

The Acquisition Strategy: Find Growth in a Declining Market

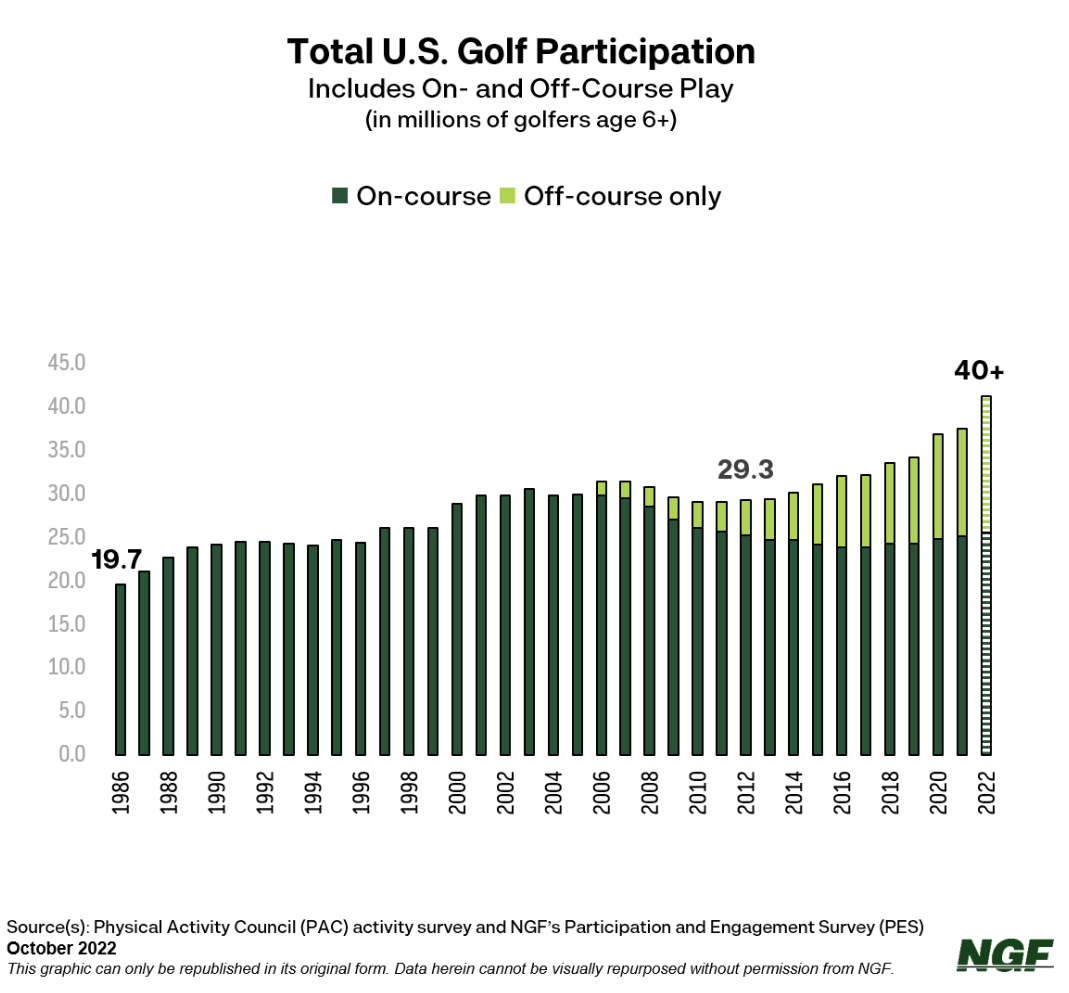

Golf has been a slowly eroding sport.

The number of people playing golf in the traditional sense (on a course) has been largely declining since the late 2000’s.

Heading into COVID, trends were bleak.

Source: National Golf Foundation

This presented Callaway with a problem. What do you do when your core market is stalling?

Big picture, there are a couple areas that a company can pursue when they find themselves in this situation:

Is there an adjacent market to explore (i.e. Tennis)?

Can they serve the same customer in a different way?

What do people that buy golf clubs also generally buy?

Is there a niche within the declining market that’s growing?

Callaway chose option number 3.

Topgolf operates entertainment-driven driving ranges. It’s like arcade games for golfers with food & drink.

Its primary value lies in the fact that it’s aimed at a target market much wider and younger than traditional golf.

Golf courses rely on participants that:

Meet a certain level of skill

Are willing to spend 4+ hours of time outside in variable weather conditions

Pay expensive fees to participate

Topgolf is:

2 hours

Much more beginner friendly

A mix of food, games, and drinks

Covered and more climate-controlled

As a result of these differences, Topgolf attracts a different type of customer than a traditional golf course.

Topgolf targets younger customers and casual golfers that spend less (or no) time on a golf course.

They value the socialization and experience more than the game of golf

This “off course” segment of the market - of which Topgolf is included - is fast growing.

Re-visit the above graphic and look at the rate of growth for off course golf participation.

As traditional golf participation has declined, this segment has grown.

Faced with the choice of continuing to try and grow in a declining market or capturing growth in this niche off course market, Callaway chose the latter.

Why It Didn’t Work

This acquisition was supposed to align Callaway with a fast-growing segment of the market and introduce Callaway to a new customer segment.

Both of these turned out to be poor assumptions.

This acquisition didn’t work because:

COVID flipped the on-course growth trajectory

Topgolf growth leveled out

Customer synergies didn’t appear

The operating model was too different

COVID Flipped the Growth Curve

On-course golf participation was declining heading into COVID but saw a remarkable resurgence starting in 2020.

In fact, 2023 had the most rounds played in the US ever.

Source: NGF

This resulted in renewed opportunity for Callaway’s core golf business.

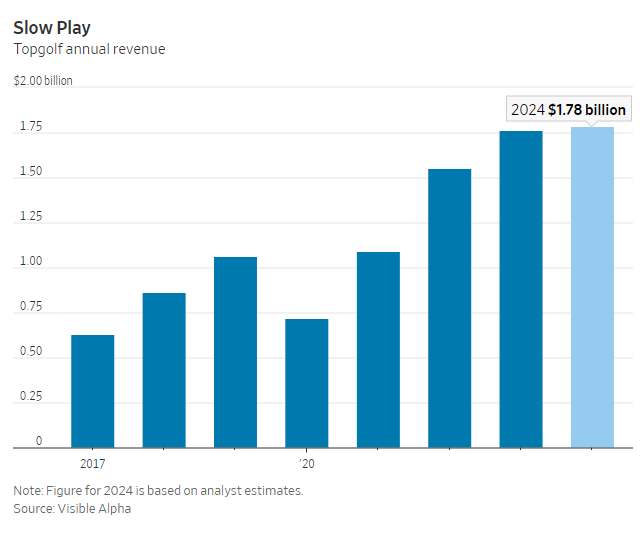

At the same time, Topgolf’s revenue stalled. Year-over-year same venue sales declined in the second quarter of this year and total revenue is expected to be about flat in 2024.

Source: WSJ / Visible Alpha

Accelerating growth in Callaway’s core market and declining growth in Topgolf was an unexpected twist post-acquisition.

Limited Overlapping Customer Value

As it turns out, there wasn’t a lot of value for Callaway in reaching a younger demographic being introduced to golf through Topgolf.

These participants weren’t converting into full golfers that would purchase Callaway’s suite of products.

Callaway was reaching a new demographic but couldn’t develop a “1 + 1 = 3” situation where the two were better together than apart.

Callaway had its customers, Topgolf had theirs, and those two groups were mostly distinct.

Completely New Operating Model

Building high-tech entertainment venues and churning out golf clubs are two very different business models.

Success in one has little relevance to the other.

This is stating the obvious but also an underappreciated challenge of growing new areas of a business.

From personal experience, a new Topgolf in Raleigh-Durham, NC was slated to open in summer 2022 and instead opened in April 2024.

Would it be any different if Callaway weren’t running the show?

Doubtful, but the point remains that effectively running this business requires:

Large upfront capital investment

Extensive site selection work

Permits, contractors, and working with local governments

High-tech products installed and maintained

…and more

Acquisitions that sound good in theory can be derailed by limited experience and knowledge executing in a new industry or business model.

Final Thoughts

There’s sound strategy behind identifying a growing niche of a declining market and aiming to align with that growth.

Callaway was unlucky that COVID upended long-term trends at the same time as Topgolf’s growth slowed. The company also didn’t fully recognize the challenges associated with Topgolf’s wholly different business model.